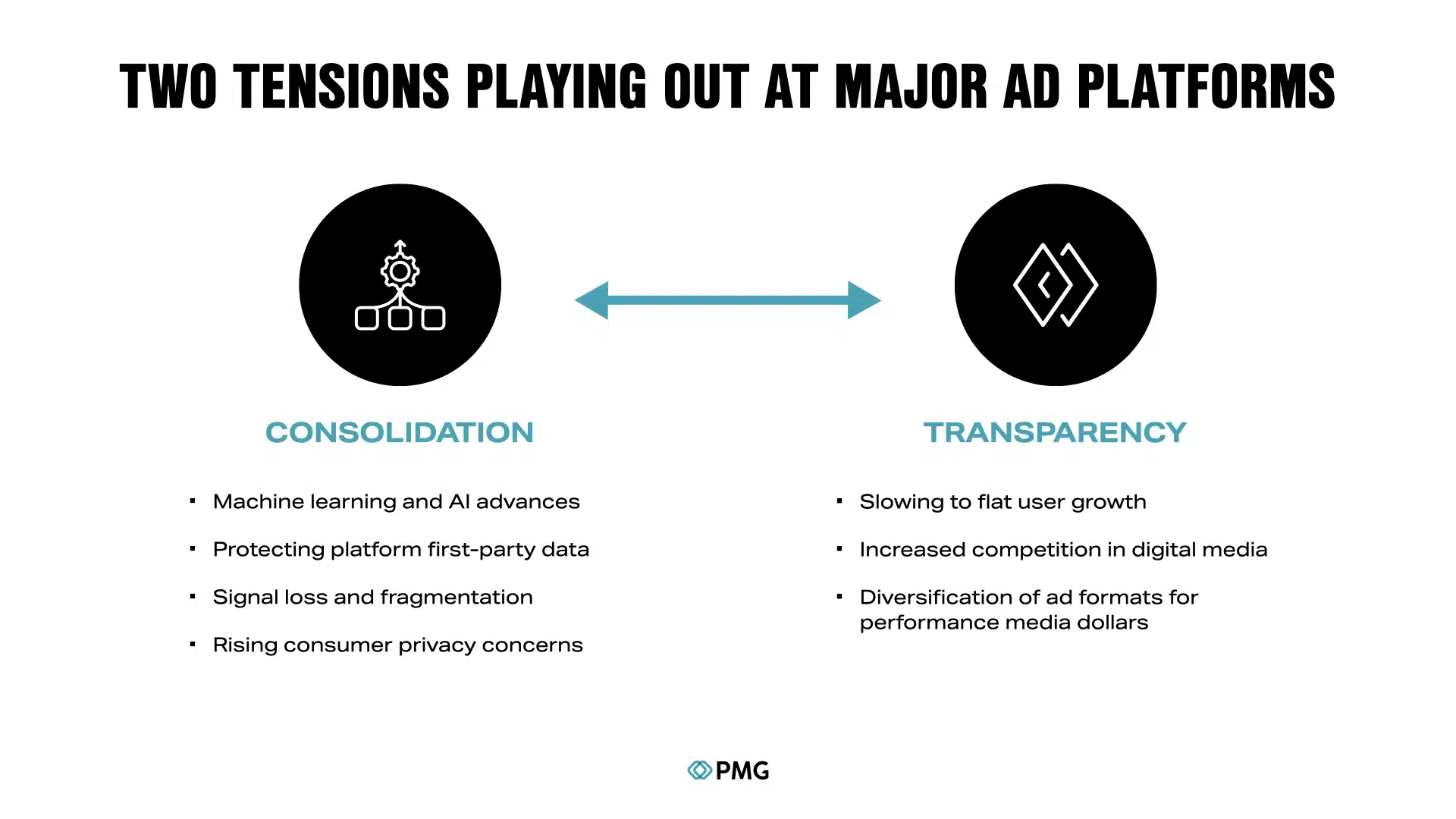

In recent years, tech giants like Meta, Google and Amazon have tightened their grip on digital media while facing increased scrutiny from consumers and regulators. Under the headlines is a key shift reshaping how brands interact with ad platforms: the growing tension between consolidation and transparency.

How consolidation and transparency are redefining digital advertising

Consolidation is growing due to several factors. Machine learning and AI enhancements allow platforms to automate ads at scale with little input from marketers. At the same time, these platforms are protecting their first-party data as privacy concerns and regulations increase. With tighter limits on third-party data, tech giants are tightening control over ad systems.

This is happening as the demands for transparency increase due to several market shifts. Less digital user growth increases competition for ad spend. New players such as retail media networks and connected television (CTV) provide more opportunities for brands to spread their budgets. In addition, brands are fighting harder to get the most out of their ad dollars on more channels, including newer platforms. These factors are pushing major ad platforms to prove their worth and give advertisers more control.

These opposing forces are reshaping the relationships between advertisers and platforms. Campaign structures such as Google’s Performance Max (PMax), Meta’s Advantage+ Shopping, Amazon’s Performance+ and TikTok’s Smart Performance Campaigns promise efficiency through automation and artificial AI. But the resulting lack of transparency means brands don’t know how effective these are.

The Rise of Consolidation: Efficiency at the Cost of Control

Google’s Performance Max (PMax), launched in late 2021, reflects the consolidation trend. Advertisers have limited control over where ads appear. The AI optimizes based on the advertiser’s goals but hides many controls that marketers are used to, such as audience targeting or channel selection.

For many brands, this “black box” approach feels restrictive. PMax serves ads across all Google-owned media, including unexpected places like Gmail inboxes, which lack the personal touch marketers prefer. Google has reduced access to auction data, making it harder to see how competitors are bidding. Despite these issues, PMax is essential for leveraging Google’s vast reach.

Meta followed in 2022 with its Advantage+ Shopping promotions. Meta overhauled its ad algorithm due to new privacy restrictions, particularly from Apple’s mobile changes. Marketers provide input such as goals, budgets and product flows and Advantage+ takes over from there. While brands appreciated performance improvements, the lack of transparency reflected the struggle with Google’s PMax.

Amazon’s Performance+, which launched in 2024, follows a similar path. It includes Sponsored Products, Sponsored Brands and Sponsored Display, which use customer data and AI to optimize ad placements with little advertiser effort. Amazon sought to differentiate itself by adding AI-powered upgrades to its DSP and stressing that it did not change reporting or attribution.

TikTok, with its smart performance campaigns, also entered this space by automating optimization across its short-form video platform, offering advertisers rapid scale with limited input.

Dig deeper: Is the digital marketing grass really greener in walled gardens?

How brands have responded

Many brands respond to this in one of three ways.

1. Advocates openness

Brands have long called for more visibility into campaign drivers and performance metrics. The lack of detailed data makes it difficult to analyze what drives success or failure. Make them feel like their investments are managed by unfathomable algorithms. Direct feedback to platforms is an ongoing effort as brands push for more detailed reporting and greater control.

2. Diversification of media spending

Many brands moved away from relying solely on the “black box” of major ad platforms by diversifying their media spend. The rise of options such as streaming video and connected television (CTV) accelerated this shift, providing broad reach and more measurable results.

As ad budgets expand to include CTV, Amazon’s growth as a major advertising player also provides more options beyond Google and Meta. Growing platforms such as retail media and digital out-of-home (DOOH) offer even more opportunities, allowing brands to develop more varied and responsible media strategies.

3. Smarter measurement

With less visibility from ad platforms, brands need to strengthen their measurement capabilities. Sophisticated media mix modeling (MMM), frequent experimentation and incremental testing are essential. Brands must build their own “source of truth” to independently measure the effectiveness of their media investments. This creates a counterweight to the performance metrics reported by the platforms.

Developing robust measurement capabilities drives accountability, ensuring platforms deliver the business outcomes they claim to impact.

Dig deeper: The Marketing Black Box: Why Radical Transparency Is Key

Green Shots of Transparency: Are Platforms Listening?

Platforms promised better performance due to consolidation – hoping that would offset the loss of transparency and control. Many advertisers, especially those with smart measurement strategies, claim that results simply haven’t materialized. Even when consolidated campaigns work, some brands and agency partners don’t feel the trade-off is worth it for other reasons, including brand safety concerns.

There are encouraging signs that platforms are starting to listen. Meta recently announced its intention to integrate “Source of Truth” bidding, starting with Google Analytics and attribution provider Northbeam. This can give brands more visibility into how campaigns are optimized. While these changes are still in their infancy, they indicate that consistent feedback from advertisers is beginning to have an effect.

Last month, Google announced new features in Performance Max to enable negative targeting at the campaign level to give brands more control. Amazon’s Performance+ made a point to include toggle controls for ad formats — seemingly in response to advertiser concerns.

The tension between consolidation and transparency remains a defining challenge in digital advertising. To push for greater control and transparency, brands must:

- Apply more data-driven rigor than ever to testing and learning as they diversify their media strategies.

- Invest in robust measurement to keep ad dollars accountable.

- Advocate for the data transparency they need to succeed.

Contributing authors are invited to create content for MarTech and are selected for their expertise and contributions to the martech community. Our contributors work under the supervision of the editors and the contributions are checked for quality and relevance to our readers. The opinions they express are their own.

#brands #dealing #lack #transparency #major #platforms #MarTech